Amazon started as a humble beginning in 1994 with Jeff Bezos as the CEO. Among the products available include electronics, kitchenware, clothing and motor vehicles. Amazon has proven to be the leading online platform where customers can be able to purchase products at a very fair price.

#Amazon 2017 financial statements pro#

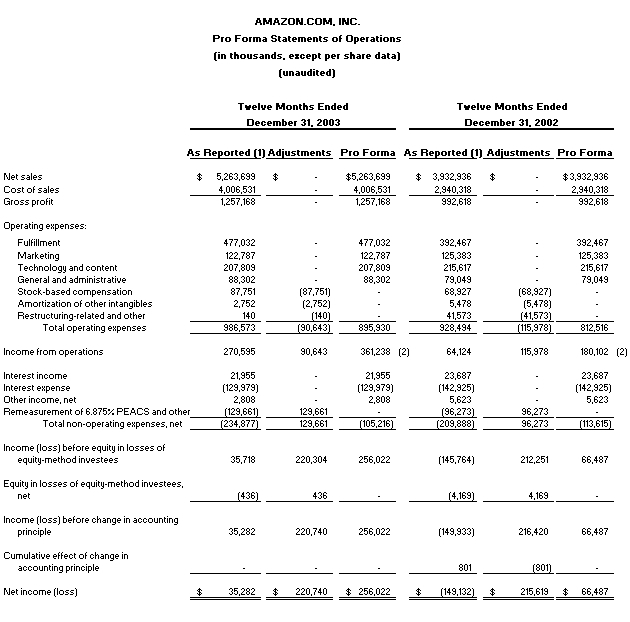

The historical statement of operations of Whole Foods Market financial information used in the unaudited pro forma combined statement of operations for the nine months ended Septemwas prepared by taking the unaudited quarterly consolidated statements of operations for the 40 weeks ended July 2, 2017, and subtracting the unaudited quarterly consolidated statements of operations for the 16 weeks ended January 15, 2017, and adding the unaudited consolidated statements of operations for the 8 weeks ended August 27, 2017.Amazon Company is one of the leading online retail companies in the world. This was done by taking the audited consolidated statements of operations for the 52 weeks ended September 25, 2016, subtracting the unaudited quarterly consolidated statements of operations for the 16 weeks ended January 17, 2016, and adding the unaudited quarterly consolidated statements of operations for the 16 weeks ended January 15, 2017. As the fiscal years differ by more than 93 days, pursuant to Rule 11-02(c)(3) of Regulation S-X, Whole Foods Market financial information was adjusted for the purpose of preparing the unaudited pro forma combined statement of operations for the year ended December 31, 2016. Whole Foods Market’s fiscal year ended Septemrepresents the period from Septemthrough September 25, 2016. Whole Foods Market utilizes a fiscal year ending on the last Sunday of the month of September and Amazon’s fiscal year ends on December 31 of each year. Management expects to finalize the accounting for the business combination as soon as practicable within the measurement period in accordance with ASC 805, but in no event later than one year from August 28, 2017.Īmazon has a different fiscal year end than Whole Foods Market. Accordingly, the pro forma adjustments related to the allocation of consideration transferred are preliminary and have been presented solely for the purpose of providing unaudited pro forma combined statements of operations in the Current Report on Form 8-K/A.

The finalization of the purchase accounting assessment may result in changes to the valuation of assets acquired and liabilities assumed, which could be material. Management made a preliminary allocation of the consideration transferred to the assets acquired and liabilities assumed based on the information available and management’s preliminary valuation of the fair value of tangible and intangible assets acquired and liabilities assumed.

Accordingly, consideration paid by Amazon to complete the Merger has been allocated to identifiable assets and liabilities of Whole Foods Market based on estimated fair values as of the closing date of the Merger. The unaudited pro forma combined statements of operations were prepared using the acquisition method of accounting in accordance with Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 805, Business Combinations, with Amazon considered as the accounting acquirer and Whole Foods Market as the accounting acquiree. persons” in compliance with Regulation S under the Securities Act. The August 2017 Notes were offered only to “qualified institutional buyers” under Rule 144A of the Securities Act or, outside the United States, to persons other than “U.S.

The August 2017 Notes were not registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws. Amazon financed the acquisition with net proceeds from its debt issuance on August 22, 2017.

0 kommentar(er)

0 kommentar(er)